Find Budget Friendly Loan Providers to Aid You Accomplish Your Objectives

In the pursuit of achieving our goals, financial assistance often plays a vital duty. Finding budget friendly funding solutions can be the key to unlocking possibilities that could otherwise run out reach. With a plethora of alternatives available in today's market, it ends up being vital to navigate through the complexities and determine the best-suited financing services that align with your goals. By comprehending the sorts of inexpensive loans, variables to consider in the selection process, and strategies for protecting low-interest prices, people can lead the means in the direction of understanding their objectives with monetary self-confidence.

Kinds Of Cost Effective Car Loans

A variety of varied car loan alternatives tailored to fulfill various economic requirements and circumstances is readily available to individuals looking for cost effective financing services. With a set interest rate, consumers can have predictable month-to-month settlements over the life of the funding, giving security and ease of budgeting.

In addition, for individuals looking to finance greater education and learning, trainee finances provide affordable settlement strategies and competitive passion prices. Comprehending the different types of inexpensive financings offered can aid people make informed choices that align with their monetary goals and conditions.

Variables to Take Into Consideration When Choosing

Tips for Searching For Low-Interest Fees

Thinking about the effect of rate of interest on the total expense of borrowing, it is important to tactically navigate the financial landscape looking for beneficial rates that next page straighten with your financing purposes. To discover low-interest rates, beginning by researching numerous lending institutions, consisting of standard banks, credit report unions, on the internet lenders, and peer-to-peer platforms. Each sort of lending institution may offer various rate of interest based on their company designs and target customers.

Contrasting offers from numerous loan providers is necessary to identify one of the most competitive prices offered. Utilize online contrast tools or deal with an economic consultant to improve this procedure effectively. In addition, enhancing your credit report score can dramatically affect the rate of interest price you qualify for. Lenders usually use reduced rates to debtors with higher credit score scores, as they are taken into consideration much less dangerous.

Furthermore, think about choosing a secured lending, where you provide security, such as a vehicle or property, to protect a reduced rates of interest (personal loans bc). Protected financings existing less danger for loan providers, bring about possibly reduced rate of interest for consumers. By applying these strategies and staying informed about current market trends, you can enhance your chances of protecting a financing with desirable, low-interest prices

Online Resources for Loan Comparison

To successfully compare car loan options from different lending institutions, utilizing on the internet sources can provide useful insights right into interest rates and terms. These systems typically require you to input information such as the loan amount, wanted payment term, and credit score to produce customized quotes from various lending institutions. Additionally, online financing marketplaces accumulated deals from different financial establishments, providing you accessibility to a more comprehensive option of financing products than you may discover by approaching specific loan providers.

How to Get Economical Finances

After utilizing on the internet resources weblink to contrast car loan options and recognize rate of interest rates and terms, the next action includes browsing the application process for safeguarding get more budget friendly loans. To use for inexpensive financings, begin by collecting all required documents, including proof of revenue, identification, and any type of various other required documents defined by the lender.

Some lending institutions might use on-line applications for ease, while others might call for an in-person browse through to a branch or workplace. Meticulously assess the terms of the financing agreement before approving the deal to guarantee it lines up with your monetary goals and capabilities.

Final Thought

Finally, budget friendly loans can be a handy device in accomplishing economic objectives. By thinking about factors such as type of financing, rates of interest, and online sources for contrast, individuals can find loan solutions that fit their needs. It is vital to very carefully research and contrast different options prior to looking for a loan to make certain cost and economic security in the long run.

In addition, for individuals looking to finance greater education and learning, student loans use cost effective payment strategies and affordable interest rates.Taking into consideration the effect of passion rates on the total cost of borrowing, it is vital to purposefully navigate the economic landscape in search of favorable rates that straighten with your car loan purposes. Additionally, online financing marketplaces aggregate deals from numerous financial organizations, offering you accessibility to a wider option of finance items than you might discover by coming close to specific lenders.After utilizing on the internet resources to contrast loan options and comprehend rate of interest prices and terms, the following action entails browsing the application process for safeguarding budget friendly car loans. By thinking about factors such as type of financing, passion prices, and online resources for comparison, individuals can find lending services that suit their requirements.

Rider Strong Then & Now!

Rider Strong Then & Now! Barry Watson Then & Now!

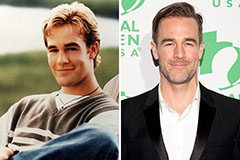

Barry Watson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Raquel Welch Then & Now!

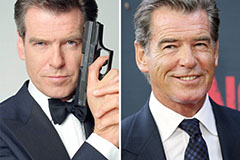

Raquel Welch Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!